What will be the future of Fintech – metaverse, NFT and blockchain

Innovation chases innovation, and digital is slowly taking over the behavior of the whole society by changing its habits. The fintech market has not been passive in the face of this transformation, and financial products and services may be getting a new, refreshed face this year.

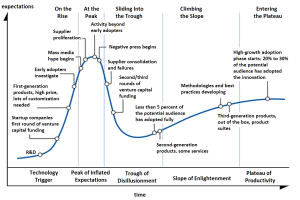

Technology begins to play an increasingly important role, not only in our space, but in our mind. We are used to smartphones as if they were our integral part of the body, and phenomena like FOMO, network narcissism, transhumanism and metaversum are already coming out of the mindset becoming more and more real challenges for society. Hype about technology seems to be increasingly precise in shaping the image of the future.

Customer Centered, or customer experience at the heart of business

On the level of the international economy, we have been dealing for a long time with a situation in which the customer himself becomes, in a way, the co-creator of a given product or solution. Financial companies increasingly start to rely on UX departments, which, using research methods, mostly qualitative research with users, help to create more optimized services for them. The Polish market itself can be a copycat, as it draws handfuls of inspiration from the Western market. – The client is in the spotlight regardless of the business line, segment, no matter how much money is in the wallet. – in an interview with MobeeDick Łukasz Kuc, the creator of the UX department in PKO Bank Polski. In the same interview, Leszek Piekut stressed that at mBank, in turn, clients take an active part in testing prototypes, and the Design Thinking corps invites clients to design and co-create banking services. The concomitant digitalization has led to customers preferring automated and intuitive applications instead of manual processes. Tools are now designed in such a way that their interiors are capable of independently recognizing and interpreting data, from which calculations and business reports are then derived. This aspect is worth mentioning in the context of trends, as it will grow with more refined research processes.

Baby banking – an opportunity for Poles or breeding customers?

Child banking is not new to the market. After typing this phrase in the search engine we will be flooded with proposals of opening an account for our child, where funds will be kept at his/her disposal under parental control. As reported in Cashless, Michal Macierzyński of PKO BP said that cashless is no longer a luxury for adults and teenagers. Adrian Kurowski from Visa in the text „Banking products for children are the first step to a safe entry into the world of finance” – says, stressing the importance of financial education from the earliest generations. This is especially important in Poland. A survey of Poles’ economic awareness and knowledge conducted by PKO showed that Poles’ self-assessment when it comes to economic literacy is very low, which is due to infrequent conversations on the subject, low level of education and lack of interest. Child banking can help to increase the financial awareness of society.

Such actions also have a second and third bottom. A parent who opens an account for his/her child is more likely to stay in such a bank, and a child who uses the service from an early age gets used to the logo, which in the future will result in loyalty to a well-known brand. Markets and crises associated with tight economic conditions, as well as constant changes in the law, are expected to drive economic education for the younger generation. For example, with greater participation of edutainment than of traditional education.

Cooperation with the market pays off!

We live in the era of open banking, implementation of deferred payments and development of social commerce. All these aspects are related to the great technical transformation of companies in the world. Digital transformation is a great opportunity for development, but also a big challenge. It is even mandatory to stay afloat on the market among the competitors who keep on biting. Companies are forced to make internal restructuring changes and base their existing management models on new goals and innovations.

In this way, they will be able to save time and resources. Obligation to constantly chase digitalization can cause business to get out of breath, as a result of which the market sees more and more cooperation between entities in this field, especially between banks and startups. For the startup it is a benefit in itself, as it receives funding and support, and the bank gets a concrete solution in a much faster way than it could expect. – We can take one off-the-shelf, highly refined solution and not spend our resources on it. I see such collaboration, for example, in the area of security. Often the result of the contractor’s work appeared after just 6 weeks, and what the startup understands by “fast” is very different than what the bank understands by that word. – said Paulina Skrzypińska, an expert from BNP Paribas.

Self-service and automated advisory systems?

Forbes describes how SofServe, operating in four areas – insurance, wealth management, investment services and capital markets – is using digital transformation to its business advantage. Using the example of insurance and the tightening situation, the market has evolved from a stationary contact to a contactless, app-based service. Increased indirect communication and a surge in online sales have contributed to the potential for increased use of artificial intelligence and other technologies. What’s more, emerging systems can use prediction to determine potential claims, assess risk or estimate losses.

Automation also contributes to better investment risk management and asset management in general. Bots implied in investment platforms can manage wealth cheaper and more efficiently than a human. Robo-advisors are gaining popularity even in Poland, with Slovakia’s Finax gaining interest among Polish investors. As reported by strefainwestorow.pl The average annual return of robo-advisors from 2018 to 2020 was 7.8%, and for a 100% equity portfolio it reached 9.4%. While the average annual return of the SPDR S&P500 ETF, the most popular exchange-traded fund, over that period was 8.13%. It is anticipated that robo-advisors may strengthen their market share by displacing brokers. The market will consequently be looking for more artificial intelligence specialists, mobile programmers and developers, as well as cybersecurity specialists.

Blockchain and crypto, or a lot of hype and money..

Blockchain technology is controversial because of its association with cryptocurrencies, which have been pejoratively referred to as money launderers and deep web services. Widespread actions by politicians and central banks, even in Poland, are trying to downgrade digital currencies in the eyes of the public and investors. KNF and NBP ran a campaign „Beware of cryptocurrencies” to talk about the risks that come with investments. Many see it as a defense mechanism for the banking sector against the outflow of significant investment funds from the bank clearing system. Blockchain is a technology that relies on recording information, and through its chain structure makes it impossible to make changes and delete blocks.

Blockchains would allow for a platform where users could instantly enter into and verify their contracts without intermediaries or central management systems. The system, by virtue of its design, would also be impartial and secure, and above all, on-demand. The crowning example here is Devoleum, a startup using blockchain for supply chain verification. Blockchain will sooner or later revolutionize the financial services market, as the banks themselves, who are investing in this technology while demonizing it, know.

– Many large banks are now investing in blockchain technology to be able to face competition from startups in the future and prevent loss of revenue. This will undoubtedly affect expectations for candidates – says Christoph Trauttenberg, Director of Michael Page Austria. The development of this technology will reduce the demand for investment advisors and wealth management professionals. For the sake of balance, the demand for experts in tax law, compliance and accounting will increase.

Metaverse and NFT, or even more hype and money!

– Metaverse offers organizations new opportunities to create value through innovative business models, and introduces new ways to connect with customers and communities – noted the executive director of PWC Hong Kong, in a Bitcoin service article.com, which details how one of the Big Four firms, PwC, purchased a piece of digital land in the metaverse. This gives the green light for investors to take a broader interest in digital goods. Artificial reality and digital user experiences will increasingly be used for monetization. Milken Institute predicts that buying digital real estate could be tempting for companies looking to build their digital empires.

There is also unprecedented publicity about the revolutionary nature of non-exchangeable tokens, which are talked about as a revolution, but few can pinpoint its core. Non-exchangeable tokens are to confirm ownership rights, determine affiliation or provide a means of value. Both NFT and cryptocurrencies are based on blockchain technology, the use of which will grow every year, and the fact that the biggest BigTech players are investing in their metaverse should give even the biggest skeptics pause for thought.

Come to the Mobile Trends Conference!

The conference that brings together the best of mobile, finance, and marketing in one place is Mobile Trends! You will be able to learn about the issues concerning the development of technology in the context of business, marketing, design, social and banking issues in Krakow on March 17-18, 2022.

The speakers will be m.in:

Artur Kurasinski (kurasinski.com),

Artur Jabłoński (digitalk),

● Piotr Kowalski (Google),

● Tomasz Witt (Norbsoft),

● Krzysztof Wojewodzic (Escola),

● Michał Szklarski (e-point mobile),

● Natalia Hatalska (infuture.institute),

● Aleksander Luchowski (Selectivv),

● Aleksandra Matysiak (Orange),

● Łukasz Okoński (Future Mind).

This will be the 11th edition of this well-known event in the IT world, where we will learn how to design, create, implement and promote applications and solutions dedicated to them.

Mobile Trends Conference is an opportunity to talk live with experts and specialists in mobile market trends. The participants will not only attend lectures, but also a great networking event.

The Mobile Trends event will also include the prestigious Mobile Trends Awards gala. See you there!