How mobile can help companies and brands grow – report „Change and People”

Strategy, analytics and results are the three things that matter now to advertisers investing in mobile advertising, according to the “Change and People” report by Spicy Mobile. The survey results published herein are commented on by representatives of four media houses: Carat, Zenith, MediaCom and Starcom.

The “Change and People” report is the next installment of an industry report published since 2017. Spicy Mobile is the most comprehensive publication on the mobile market in Poland and every year brings together experts representing advertisers, publishers and service providers. This year’s edition is enriched with the results of a survey on the situation on the media market conducted in the summer of 2021 among people responsible for planning and buying media. A total of 144 surveys were collected, mostly from people representing the largest media houses in Poland.

“The pandemic has accelerated change in the media market,” admits Artur Zawadzki, Partner at Spicy Mobile. – “Comparing this year’s results with data from a year ago, which came from the first wave of our survey just after the lockdown, brings a lot of interesting conclusions about the direction of these changes, the current mood in the advertising industry, the position of mobile and upcoming trends.”.

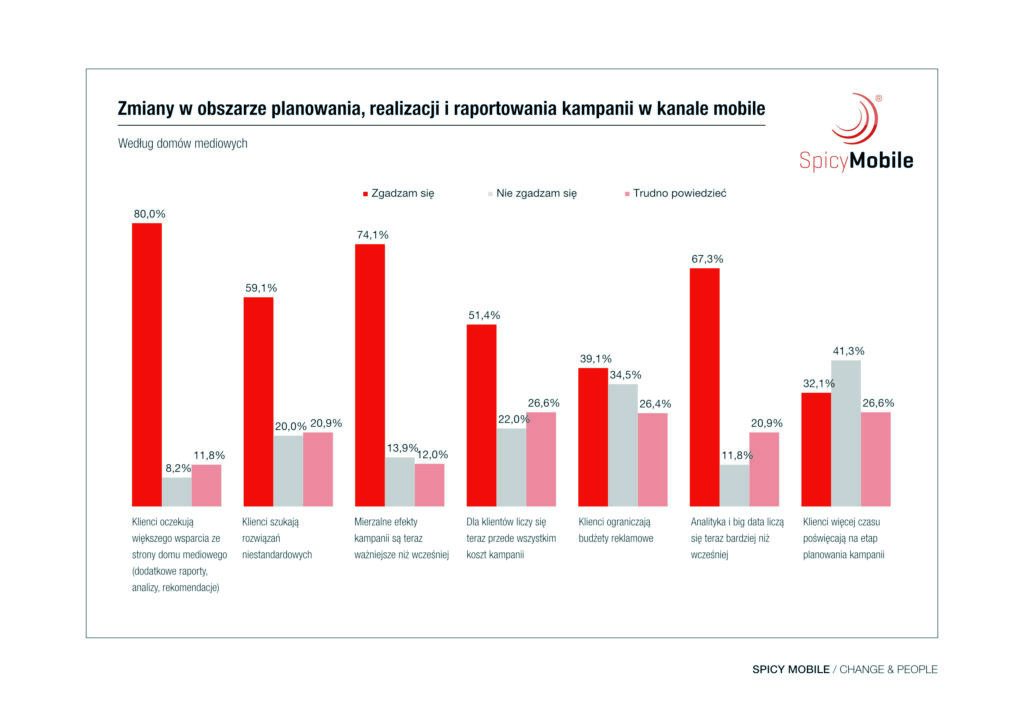

What are advertisers’ expectations from media houses? Similarly to the previous year, advertisers expect above all more support from a media house in the form of additional reports, analyses or recommendations. This option was indicated by 80% of respondents working on the side of a media house (in 2020. it was 85%). Since the first wave of the survey, the role of analytics and big data has increased (from 41.8% to 67.3%), as well as the ability of media house to deliver measurable campaign results (from 62.7% to 74.1%).

The survey results agree with Malwina Marczak from Carat media house: “In fact, there is an increasing need for support from media houses, especially in the form of additional reports and analyses. Therefore the possibility of precise and comfortable measurement of campaign effects is a great asset when choosing media and suppliers”.

In a similar vein Emilia Ignaczuk from Zenith: “Awareness and knowledge of clients and agencies on the subject of measuring the effects of campaigns is getting higher. Both parties are well aware that the approaching post-cookie era is on the one hand a challenge, but also an opportunity for the development of their businesses”.

What else media houses’ representatives pay attention to? As we can read in the “Change and People” report, interest in non-standard solutions has decreased compared to last year. Pandemic has forced brands to be more flexible and adapt their communication to current events. There was also a shift in advertising budgets between channels. Shortly after the first lockdown, as many as 64% of media house representatives surveyed believed that advertisers expect a non-standard approach to campaign planning on mobile. In the second wave of the survey, more than half of those surveyed (59.1%) agree.

According to Izabela Zielonka of Zenith The future of mobile advertising largely depends on big data: “Clients have expanded their knowledge of campaign performance reporting capabilities. They are increasingly concerned with reaching the user as precisely as possible, often based on benchmarks from previous activities. This makes it clear that analytics and big data will have an increasing impact on advertising campaign planning.”.

According to Spicy Mobile analysts, a sign of a return to normality are the results for advertising budgets. As the comparative data shows, the percentage of people on the media house side who believe clients are cutting ad budgets (39.1%) and only pay attention to campaign cost (51.4%) has declined.

“Advertisers have understood that the pandemic is our new reality that we must learn to live with, and that reducing advertising budgets is not an option. The proof is in the numbers, and they are trusted by customers. The need to confirm the effects of actions in reports and in-depth analyses has been growing stronger over the years”. – comments Sylwia Szatyńska from MediaCom.

What marketing objectives are advertisers pursuing??In 2020., After the first lockdown, marketers focused mostly on measurable, performance goals. The most common marketing objectives included increasing sales (95.9% of indications), increasing website traffic (62.9%) and acquiring leads (61.9%). Less than half of respondents mentioned image objectives, even less building relationships with existing clients (25.8%).

Compared to 2020. the position of image goals increased significantly (from 48.5% to 76.3% of indications), such as building brand recognition or improving image. The surveyed media industry representatives also believe that marketers attach much greater importance to customer relations – the percentage of indications for customer loyalty increased by 9.3 p.p. up to 35.1%. Thus, the disproportion between sales and other marketing objectives decreased, although sales objectives are still the most important for advertisers (80% of indications).

“The goal is no longer just the outreach itself, but more importantly its quality. Our task is to use the best possible tools to plan and optimize campaigns” – sums up the current situation on the market Paulina Deja from Starcom.